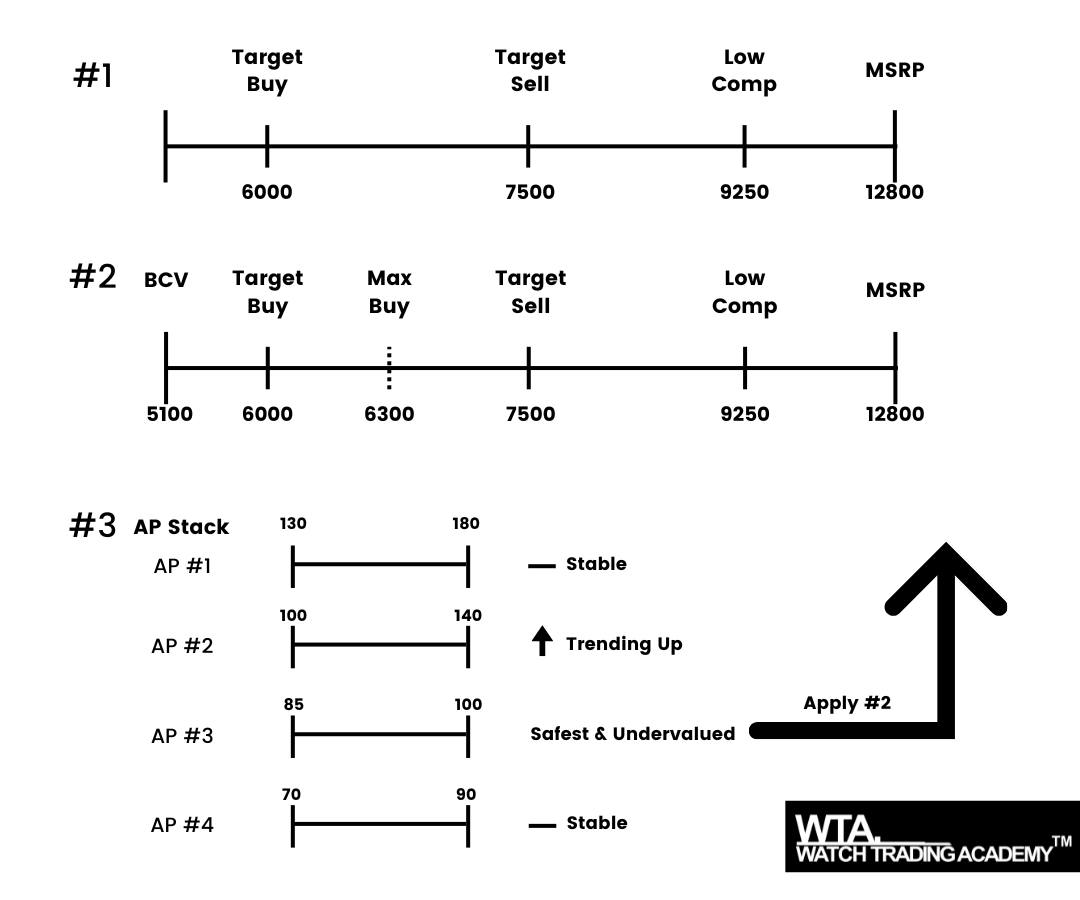

When you analyze deals, which of these does your analysis look like? Are you Trader #1 trying to move to Trader #2?

I’ve always said the watch business isn’t a guessing game, every decision is just elementary school math.

That’s why, in my opinion, it’s way better than flipping anything else as it’s extremely predictable.

I go into every deal knowing exactly what I should have paid and what it will sell for.

I commonly see two types of traders struggling:

Rookie Mistake 1: Not confident in their deals.

“Am I buying low enough? What’s the max I should pay?”

This should be a clear cut math decision.

Rookie Mistake 2: Traders that are flipping and making money, but they don’t realize they’re doing the types of deals where after 20 profitable flips, the 21st deal will wipe away all their profits because they have bad risk management.

Imagine making money for 3 months straight and being back at 0 or negative on month 4…

You should be buying the deals with the biggest upside and minimized risk.

Again, it should be clear cut math.

Trader #1 is assessing a deal based on simple buy low, sell high. Great for getting started but not yet ready to operate as a real business.

Trader #2 is trading based on risk vs reward and also saying no to profitable deals if risk is too high.

If they’re offered 3 deals, they can mathematically choose which one to say yes to and broker the rest.

This is how you build an efficient business.

Trader #3 is flipping undervalued watches so they’re trying to flip something that could jump up in price as a bonus.

This turns a $5k profit into $15k overnight.

You can also escape downtrending markets into stable markets.

That’s what separates you from those that go out of business during a market crash.

By maximizing this approach you blow past the competition with a balanced portfolio bringing Wall St to the watch business.