There seems to be some confusion about the differences between Bottom Cash Value (BCV), Target Price, Wholesale, and Retail.

These definitions in regards to watch trading are taught to help you make smart investment decisions. You may not realize it yet, but by understanding all of these numbers, you can build out a risk/reward spectrum on each watch deal you trade to give you a stronger sense of if it’s worth it or not. Having this knowledge will help you stay disciplined when making decisions and keep you from getting emotional about your purchase. It will also tell you in a clear light if the deal is great or just okay.

Remember, numbers don’t lie, people do.

So let’s start by breaking down the definition of each price range on the watch trading scale.

First – Bottom Cash Value. Bottom cash value is the number that the watch carries as an asset at the very core of how it’s made (materials, brand value, craftsmanship). This number is the number that you can get selling this watch if your back is up against the wall and you need to liquidate the watch IMMEDIATELY! This can be a number a jeweler will give you for your watch right now cash on the spot, or someone else will give you for it on any given day, no matter how tough the economy is, and what the brand is doing. This is the true core value of the watch at its lowest form, and the BCV number is a number where you can’t lose money.

Often times people mistake Bottom Cash value for an extreme low-ball price someone offers them to try to steal the watch. That’s not necessarily BCV, and you shouldn’t be tricked by these clowns. Instead, find BCV on any watch by calling a jeweler or dealer and getting the amount they would pay you for your watch cash today. Sometimes they will give you a quote and other times they won’t. That’s why it’s great to leverage the MSRP charts provided in WTA Part 2 that allow you to calculate these BCV numbers. BCV is the intrinsic value of the watch, and is the starting point of your risk/reward spectrum.

Second – Target Price. Target prices on specific watch models vary. And this can get confusing if you don’t know what target price is because sometimes target prices for one watch are BCV. Other times, Target price is nowhere near BCV. This is because certain watch brands follow a value based approach where you want to aim to take X% off of MSRP retail price, and other brands take a market based approach. The value approach would be, for example, taking 80% off of MSRP for any steel and gold Blancpain model.

Whereas in contrast, a market approach goes off of looking at other relevant comps on the open market, and trying to be 20% or $2K less than those comps. The number you use is whichever is more appropriate. Obviously the lower of the two the better, but this formula isn’t always right, so you should analyze the market before making an offer on one of these types of models.

Target prices for watches are typically anywhere at or above BCV up to low wholesale. If you stay in the target price range as a trader you should do well.

Third – Wholesale. Wholesale pricing is interesting because it can seem like you’re getting a good deal when you’re the buyer. When in fact, Wholesale prices are typically Low enough to seem like a good deal but really they’re too close to the lower end of retail prices to make strong profits. That’s not to say you can’t make money buying wholesale, and flipping those pieces. You absolutely can. But it takes much more volume to sell to reach numbers that make a dent than it does if you’re buying at target instead and selling to retail buyers. Sometimes target prices intersect with wholesale at the lower end of the spectrum but often Times buying wholesale is too much risk for too little reward and so it’s better to just broker those deals instead of inventorying them.

Fourth – Retail. These are your prime time buyers you want to sell to and sellers you want to buy from as a watch trader. This is the region of the spectrum where you make your maximum profits and get some of the steepest discounts on deals.

Retail consumers don’t know as much as traders and die hard enthusiasts about watches, so they rely on a trusted individual/business (you) to help guide them. Retail prices are the prices the watches are being offered at to the general public. You’ll find these prices looking oneBay, Chrono24, and Google for starters. You can use these platforms and their tools like past sales to start formulating what you’ll aim to sell your watches at to retail buyers.

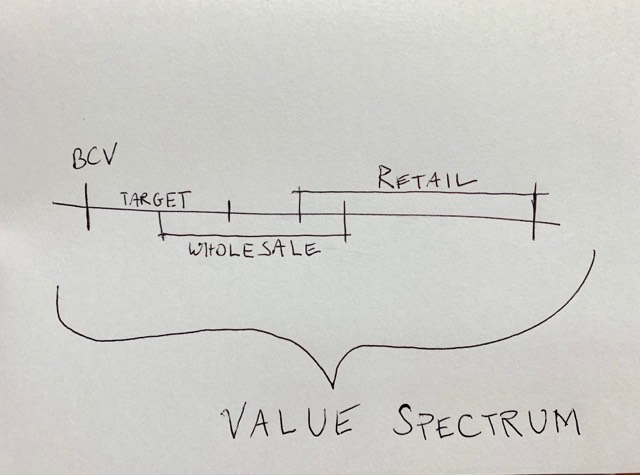

So once you put these four numbers all together in a straight line on what I call the Value Spectrum, you can plainly see what you’re downside risk is (lowest being BCV), and upside potential is. By having these numbers in front of you, you can make the decision then and their if this purchase is going to be worth you putting your funds into or not. If the risk range of the spectrum is greater than or equal to the reward that trade is generally great, and you can choose to avoid it. Some people are okay with the small margins to take on that greater Risk side, but in the long run, it’s never worth it.

When you have a deal where the reward outweighs the risk, then you should be in a very strong position to make money and end up crushing it unless you’re too impatient or get anxious and dump the watch.

See the diagram for further explanation. Now go out there and trade watches like disciplined seasoned vets!